The CPF Group has recorded impressive financial performance for the year ending 2024, with its total assets under management hitting KSh85 billion, buoyed by strong growth across its pension schemes and a significant increase in membership.

The Group’s flagship retirement schemes posted robust results, reflecting prudent investment strategies, operational efficiency, and expanding reach among Kenyan workers, especially in the public sector.

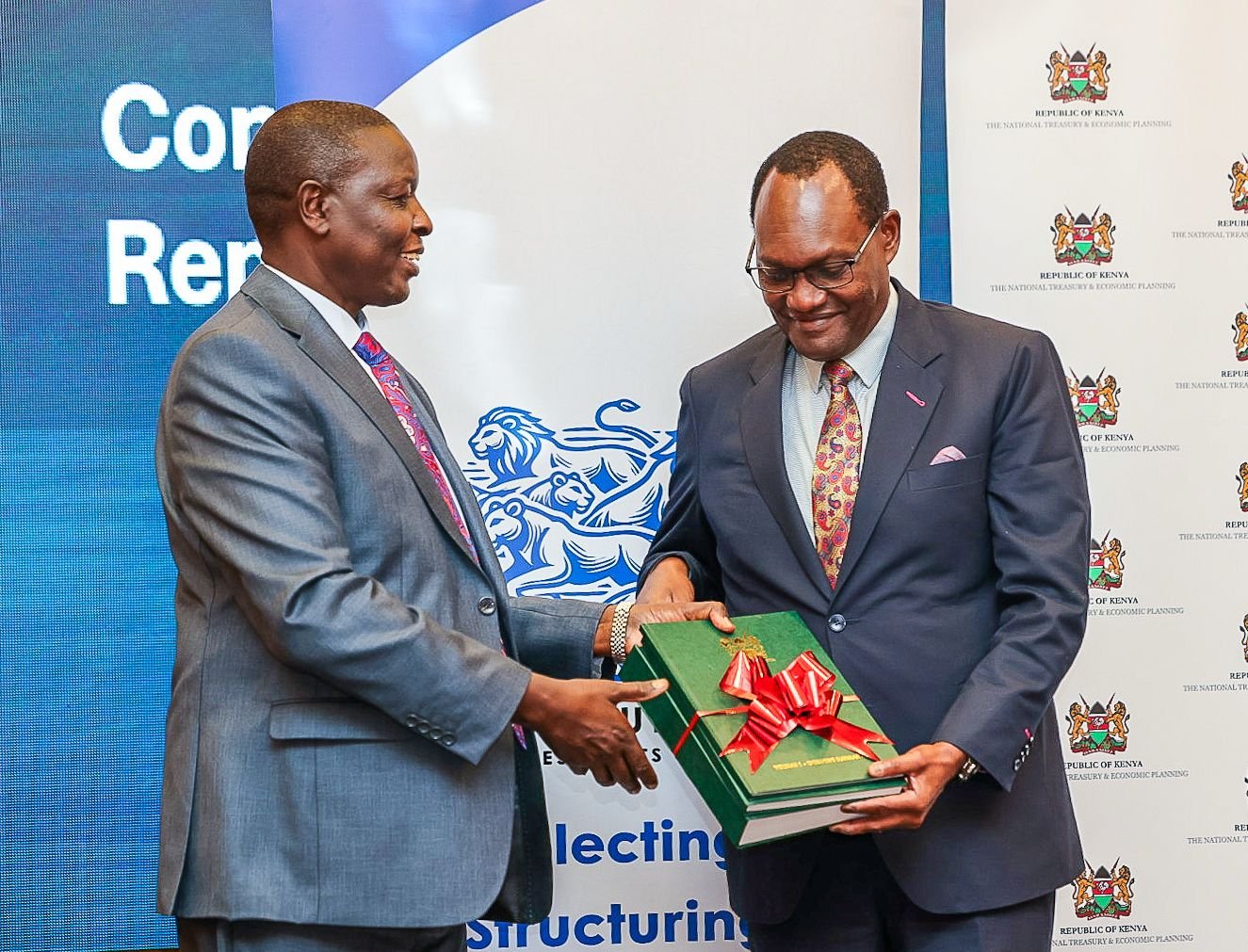

CPF Group Managing Director and CEO Hosea Kili attributed the Group’s stellar performance to prudent fund management, deep understanding of member needs, and a strong commitment to financial literacy, innovation, and strategic partnerships.

The LAPTRUST Defined Benefit (DB) Scheme, one of the Group’s cornerstone pension products, grew its net assets to KSh28.1 billion, up from KSh26.99 billion in 2023. This steady growth reflects LAPTRUST’s consistent investment strategy and ability to deliver returns despite a challenging macroeconomic environment.

Meanwhile, the County Pension Fund (CPF) registered the most significant increase, with net assets soaring from KSh36.97 billion in 2023 to KSh51.67 billion in 2024 — a 40% jump. This remarkable performance underscores the scheme’s rising popularity among county governments and public service employees.

CPF Group’s auxiliary schemes also recorded strong performance, reflecting the growing diversity of retirement needs among Kenyans. The Salih Fund, a Shariah-compliant pension product, attracted 9,895 members, underscoring the rising demand for faith-based financial solutions. ThePost-Retirement Medical Fundgrew its assets fromKSh32.8 million to KSh55.2 million, signaling greater awareness and planning for healthcare needs in retirement. Meanwhile, theCPF Individual Pension Scheme, which targets self-employed individuals and those in the informal sector, posted a remarkable 42.4% increase in assets, climbing toKSh4.11 billion, cementing its place as one of the leading voluntary retirement savings plans in the country.

Membership and Institutional Growth

The Group experienced a surge in active members, with the total number rising to 94,116. Over 17,500 new members joined in 2024 alone, underscoring the growing trust in CPF Group’s products and services. Additionally, the number of sponsoring institutions grew to 194, reflecting strong partnerships with county governments and other employers

Despite prevailing economic headwinds, the Group declared a competitive interest rate of 8.8%, delivering real value to members’ savings and reinforcing its promise of long-term financial security.

CPF Group Board Chairperson Maurice Nduranu described the 2024 results as a testament to the Group’s market leadership and operational resilience. He emphasized that going forward, CPF Group would prioritize high-impact investments, technology-driven service delivery, and strong governance structures to ensure sustainability and enhance retirement outcomes for members.